I just wanted to post a short update today. Yesterday, I posted an update to my options trading and mentioned I was holding NFLX put spread through earnings. The value never gave me an option to close during trading yesterday. At market close the trade closed with my P/L showing $13 gain (which would have been impossible to get out right at that moment). This morning I closed the position for a total profit of $25 so I made $12 holding that trade overnight. I will tell you what is was nice to be able to make that profit but I watched the price action all night. It definitely ups the stress holding a position like that.

In order to see how these earning plays work out. I put another IC on for EBAY. The IV rank is 77. I brought in $.48 dollars for $1.50 wide wings. The short strikes are $36 and $32. As long as EBAY moves less than 6% for earnings I should be able to make a profit on this trade. Below you can see the trade I put on.

Check back soon to see if I made it with this EBAY trade or not.

Financial Success for Starters

I want to give you the financial tools and savings advice to help you achieve financial success

Tuesday, April 18, 2017

Monday, April 17, 2017

Options Trading Update 4/17/17

Hello and welcome back! I know it has been a minute since I have posted an update and I apologize for that. I guess I didn't feel there was anything noteworthy to discuss because I have just been mechanical on taking off positions when they around 25% net profit. Below I will post my P/L for you to see and explain some adjustments I have been making to my account, as well as some learning experiences.

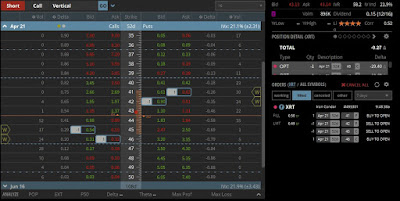

One of the big learning experiences is watching the decay (really the lack there of) on underlyings that are coming into earnings. The two underlyings that had earning before expiration of the current cycle were CSX and NFLX. I got out of my IC on CSX last week at 25% of net profit but it had just started to decay last week. I actually rolled this position out to May with some wider strikes. NFLX was my other position, which still hasn't hit a profit target yet and is reporting earnings tonight. I am going to hold this position through earnings because I think the IV crush will be beneficial and I don't think I am in a whole lot of trouble with this position. As seen below I am short the $137 put and long the $136. With the underlying right around $146.85 as I write this right now I think I can exit this position with a nice profit tomorrow. I would have expected to be able to exit prior to today due to theta decay, but IV in the front month appears to be increasing into earnings. I will probably stay away from NFLX in the future due to liquidity in their options.

One of the big learning experiences is watching the decay (really the lack there of) on underlyings that are coming into earnings. The two underlyings that had earning before expiration of the current cycle were CSX and NFLX. I got out of my IC on CSX last week at 25% of net profit but it had just started to decay last week. I actually rolled this position out to May with some wider strikes. NFLX was my other position, which still hasn't hit a profit target yet and is reporting earnings tonight. I am going to hold this position through earnings because I think the IV crush will be beneficial and I don't think I am in a whole lot of trouble with this position. As seen below I am short the $137 put and long the $136. With the underlying right around $146.85 as I write this right now I think I can exit this position with a nice profit tomorrow. I would have expected to be able to exit prior to today due to theta decay, but IV in the front month appears to be increasing into earnings. I will probably stay away from NFLX in the future due to liquidity in their options.

I instituted a new rule for myself and that is to leave my ICs alone. Everytime I adjust my ICs I get tested on the other side. So I believe it is best just to leave them alone. I have made it out pretty much unscathed from these adjustments, but I would have kept my trade costs lower and probably my stress level lower after the adjustments when it tests the other side. My other adjustment is to make less trades but make them a little larger with wider wings on my ICs. I am going to shoot for $2 wide now. The other benefit to doing this other than allowing me to have a greater POP is that my theta numbers are higher. Below is my current P/L and I am hoping to start to see this turn around in my favor here soon but we will keep a watch on it.

As always thank you for your time. I always appreciate getting feedback, if you have any suggestions please let me know. Also, if there is anything you would like me to go more in depth with when I post about my portfolio let me know so that I can cater to you my fellow readers.

Tuesday, March 21, 2017

Options Trading Update

Hey, it's been a while since I have updated my trades so I will give a synopsis of what I currently have on and what I have closed or adjusted. As I write this before market open I have a Net Liq of $594.69 and $60 of buying power available. So far my realized P/L is $(87.15), that stupid TSLA trade is still following me. If I hadn't made that TSLA trade I would be up $55. You can see my overall P/L below.

So, since the last time I wrote here, I got out of the NVDA trade I put on a couple days after entry. I was tested on both sides of the iron condor and got out for a small profit. I closed my JNJ put spread for a $26 loss. I will be shying away from debit spreads due to the burn by JNJ. I closed my WMT Iron Condor at a $17 profit. I closed my XLE call spread around my 50% of max profit.

On March 6, I put an Iron Condor on in X. For this trade my call strike prices are at $42 & $43 and the puts on the original trade were $32 & 31. I this trade brought in $38 with a $62 at risk. The original trade is below. I closed this trade yesterday at $11 which is a little more than 25% of max profit

So, since the last time I wrote here, I got out of the NVDA trade I put on a couple days after entry. I was tested on both sides of the iron condor and got out for a small profit. I closed my JNJ put spread for a $26 loss. I will be shying away from debit spreads due to the burn by JNJ. I closed my WMT Iron Condor at a $17 profit. I closed my XLE call spread around my 50% of max profit.

On March 6, I put an Iron Condor on in X. For this trade my call strike prices are at $42 & $43 and the puts on the original trade were $32 & 31. I this trade brought in $38 with a $62 at risk. The original trade is below. I closed this trade yesterday at $11 which is a little more than 25% of max profit

I closed my XRT trade for $10 which was 25% of my max profit and reestablished the trade adjusted down for the stock price. My current iron condor strikes on the call side are $44 & $45 and the put strikes are at $41 & $40. I brought in $32 with $68 at risk.

I have placed some more trades on ETFs following the Indices. I have an iron condor on IWM that brought in $40 and an iron condor on QQQ for $36. My GM iron condor is in trouble right now and my GDX iron fly is behaving but I am looking for an exit if I can get one from it.

This week I but an IC on BX which is already approaching a potential 25% profit target. I sold a put spread on NFLX for $32, and an iron condor on CSX for $32. I am trying to be more mechanical and only collect 1/3 the width of my strikes to remove some delta risk from my portfolio. I am keeping my strikes on my spreads $1 wide to stay mechanical until my account becomes larger. Now, I also start looking to manage trades at 25%. My evaluation at the 25% profit target won't be mechanical managing, if I am comfortable with the position then I will stay in it. Tastytrade was discussing the earlier managing of winners removes some P/L volatility. Collecting the 1/3 the width of the spread strikes should allow me to stay in theses trades closer to a 50% profit target with less issues of being tested. I am hoping that these small adjustments will give me some more consistent success, and allow more profitability. As always feedback is always welcomed and appreciated.

Friday, March 3, 2017

Follow Up On Febrauary

So if you are new here I am tracking a micro options trading account. I started a couple of weeks ago with $560. You can read about my first trades here, and I put some other trades on in this post. Let's jump right into what I have done in my account in the last couple days.

On 2/28/27, I put an Iron Condor on XRT netting $.50 with $1 wide wings. This underlying has an IV Rank of 47 at the time of this writing. My short call is at the $45 strike and the Short put is at $42. Depending on how this behaves in terms of volatility I may manage this as an Iron Fly. Below you can see the charts and where I put the trade on.

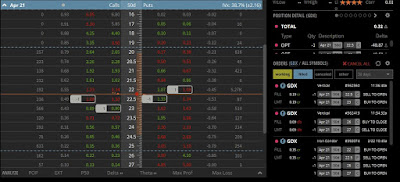

Yesterday, on 3/2/17, I moved my Iron Condor in GDX to an Iron Fly. I netted an extra $0.10 in premium and now only have $.05 at risk in this trade with 49 days left till expiration. I am not feeling very good about GDX coming back my way unless the Fed decides not hike rates. However, I feel comfortable letting this ride with $5 on the table. If I can get out of this trade for a profit I will be happy. Below you can see the updated trades on GDX and can see where I bought back the higher call spread and sold the new call spread to make this an Iron Fly.

Any advice is always appreciated, and check back soon for more updates in trades in my Micro Options account.

On 2/28/27, I put an Iron Condor on XRT netting $.50 with $1 wide wings. This underlying has an IV Rank of 47 at the time of this writing. My short call is at the $45 strike and the Short put is at $42. Depending on how this behaves in terms of volatility I may manage this as an Iron Fly. Below you can see the charts and where I put the trade on.

Yesterday, on 3/2/17, I moved my Iron Condor in GDX to an Iron Fly. I netted an extra $0.10 in premium and now only have $.05 at risk in this trade with 49 days left till expiration. I am not feeling very good about GDX coming back my way unless the Fed decides not hike rates. However, I feel comfortable letting this ride with $5 on the table. If I can get out of this trade for a profit I will be happy. Below you can see the updated trades on GDX and can see where I bought back the higher call spread and sold the new call spread to make this an Iron Fly.

Putting the Iron Fly on in GDX freed up some buying power for me and I put on my last trade which is an Iron Condor in NVDA for the March Expiration. I put the trades on at the 40 Delta and netted $0.71 with $1 wide wings on the condor. This seemed like a really nice risk reward matrix on NVDA. Check out the chart and trade below.

One of the things that I think has happened is that IV has expanded since I put on my other trades otherwise I would believe I should be looking to manage some of these trades soon. I have been mentored by many of you reading these either here or on r/options, I appreciate all the feedback. I promise I won't be a one trick pony with these Iron Condors forever. I appreciate all the help you have shown me and I hope I can show you that your advice has fallen on good ears with some winning trades. In closing, you can see my P/L to date, and the only loss I have locked in is that dumb move I did in TSLA with their earnings.

Any advice is always appreciated, and check back soon for more updates in trades in my Micro Options account.

Friday, February 24, 2017

Don't try and Catch a Falling Knife

I made my first post about trading options on Wednesday in my micro options account. You can read about the first trades I made here. The rest of this post will be about the rest of the positions I opened this week and so that we can track how they perform in the future. My goal is to summarize all of my trades until there are too many for us to track. In my first week of trading I made my first huge mistake and broke the rules. I made an out sized trade for my account and messed up. Man it sucked but it was a great learning experience.

So, yesterday I made my first huge mistake in my option account. TSLA opened down 5% and I thought I could sell a put spread with the 1 DTE weekly. The trade seemed like a slam dunk. I collected $94 for $250 risk selling a 260 Put and buying a $257.50 put. TSLA blew through the strikes and never came back. I ended up closing the trade this morning for $237 for a $143 loss. Luckily, I didn't blow up my account and will live to trade another day. The $250 of risk was way too large for my micro options account. There is a term in the options world don't try and pick up pennies in front of a steam roller, well I did, and I got crushed. See the charts and options chain below.

Today, I put on a March 17 Iron Condor in WalMart. My short call at $72.5 and my short put at $70 I went $1 wide with my wings. For that I brought in $51 which I think is a great risk reward trade off. The trade skews bearish on Deltas and that is partly by design the WalMart chart looks like it is setting up for a pull back. Since it is shorter duration I should see Theta come in and start working for me. Below is the chart and trade for the Walmart trade.

The last trade I got watching tastytrade this morning. A woman called in and had put in long put spreads on JNJ. The chart shows a bearish pattern but the stock has gapped up with no pullback. I got into the trade for a $34 debit. I went long the $115 April 21 put and short the $110 put. The stock is a $122 but we should see some consolidation from that level because the stock has moved straight up. If this trade goes in my favor it stands to really help my account with a max profit of $466. Below you can see the char and trade on JNJ.

On my earlier trades they are all going fine. GM tested my short put this morning, but has moved back above it. The other trades are moving like they are supposed to. I still have $120 in option buying power, I am going to keep an eye on my trades for now hopefully collect some profits in the mean time. Hopefully, there will be some more compelling trades like the Walmart and JNJ come soon. My portfolio currently has a -6.08 Delta and 1.05 Theta.

Thank you for reading and as always I look forward to getting some feedback.

So, yesterday I made my first huge mistake in my option account. TSLA opened down 5% and I thought I could sell a put spread with the 1 DTE weekly. The trade seemed like a slam dunk. I collected $94 for $250 risk selling a 260 Put and buying a $257.50 put. TSLA blew through the strikes and never came back. I ended up closing the trade this morning for $237 for a $143 loss. Luckily, I didn't blow up my account and will live to trade another day. The $250 of risk was way too large for my micro options account. There is a term in the options world don't try and pick up pennies in front of a steam roller, well I did, and I got crushed. See the charts and options chain below.

Today, I put on a March 17 Iron Condor in WalMart. My short call at $72.5 and my short put at $70 I went $1 wide with my wings. For that I brought in $51 which I think is a great risk reward trade off. The trade skews bearish on Deltas and that is partly by design the WalMart chart looks like it is setting up for a pull back. Since it is shorter duration I should see Theta come in and start working for me. Below is the chart and trade for the Walmart trade.

The last trade I got watching tastytrade this morning. A woman called in and had put in long put spreads on JNJ. The chart shows a bearish pattern but the stock has gapped up with no pullback. I got into the trade for a $34 debit. I went long the $115 April 21 put and short the $110 put. The stock is a $122 but we should see some consolidation from that level because the stock has moved straight up. If this trade goes in my favor it stands to really help my account with a max profit of $466. Below you can see the char and trade on JNJ.

On my earlier trades they are all going fine. GM tested my short put this morning, but has moved back above it. The other trades are moving like they are supposed to. I still have $120 in option buying power, I am going to keep an eye on my trades for now hopefully collect some profits in the mean time. Hopefully, there will be some more compelling trades like the Walmart and JNJ come soon. My portfolio currently has a -6.08 Delta and 1.05 Theta.

Thank you for reading and as always I look forward to getting some feedback.

Wednesday, February 22, 2017

First Options Trades

So I finally got my account funded and ready to trade today. I had $560 to work with in buying power. I am going to be a premium seller focusing on defined risk trades since I have a small account and want to maintain enough buying power to put on as many small trades as possible. If you want to learn about selling options I highly recommend tastytrade.com they have many resources available to learn about the process of selling defined risk options strategies. My goals here are to grow my account, but if I don't lose money in this learning process I would still consider that a win.

So I set some basic rules for myself for getting into trading. First I only picked out underlyings that seem to have enough volume to support getting in and out of these trades, with a tight bid/ask. Next the trade had to pay me 1/3 of what my max risk was on the trade. Third I will manage my trades at 50% max profit because statistically it gives you a higher win percentage, as soon as I had a trade filled I put a GTC (Good Till Cancel Order) on to get out of the trade at 50% profit. If the trades move against me then I will manage them by rolling up the untested part of the trade, rolling it out to a back month, or taking the loss if I don't feel I can manage the trade.

I put on 4 trades today that expire on April 21 so they have 58 days till expiration. I think these are enough trades to learn and not eat all my bandwidth so that I can watch them, also it leaves me some buying power to get out of the trades or make more future trades if opportunities present themselves. The 4 trades brought in a credit of $138.97.

My first trade was an Iron Condor on SPY. I chose SPY because it is extremely liquid and tracks the S&P 500. I know the market is hitting all time highs but the market should be range bound to some extent, I don't see the market ripping higher or selling off strongly at this point. I think the stock market is due for a pull back but didn't want to go against the market since it can stay irrational longer than I can stay solvent. My call side of my condor includes selling the 242 Call and buying the 243 call. On the put side I sold the 230 put and bought the 229 put. I collected $.41 credit or $41 before commissions. With my wings only being one strike apart my risk is $100 dollars. Below you can see the chart on the chart on SPY and the image below that is the set up to my trade.

The next trade I put on was on GDX it is an ETF consisting of Gold Mining stocks. I placed an Iron Condor on GDX at similar deltas to the SPY trade. I did this because it has a negative correlation to SPY and should offset some of the risk in case the SPY trade goes against me. I collected $.35 credit or $35 I put the Iron condor on around 30 Delta. Below is the setup of the trade and the chart for GDX. Due to the setup of the strikes I have a $50 max loss to the downside and $100 max loss to the upside.

As I was listening to Tom and Tony this morning they put a strangle on GM so I followed with a little bit wider on the deltas and put the wings on it to make it a condor so that I could define my risk. I put this on around the 40 Delta and brought in $.63 or $63. For being new this is a little to close to the money for me to be extremely comfortable with it and my strikes don't give me alot of room to defend it, but someone said you have to risk it to get the biscuit. As before the set up of the trade and the charts are listed below.

The last trade I put on was a short call spread on XLE. The chart shows this in a down trend right now and I think it should stay in the trend while I am in this trade. For the trade I collected $.16 $16 with $50 at risk. Here I put the trade on around 36 Delta. Below are the charts and and the set up of my vertical spread.

All in all as I mentioned I brought in 138.97 in premium and my account went from $560 to $698. My portfolio has -3.54 Delta and .81 Theta. So I am neutral and as we move to expiry the value should come down on these options so that I can hopefully get out of them with a profit. If you are a veteran I encourage critiques of my trades, I would love to hear why and how you would do it differently so that I can learn. If you are a rookie, I encourage you to head over to tastyworks.com to learn more about options and see if this is something you are interested in. I would love to hear some feedback. Stay tuned as I update how these trades went, any new trades I put on and how my portfolio performs as I continue trading.

Want to watch me learn options trading?

I have what I believe will be an interesting new thing for you. I am going to start doing some options trading and posting my successes and failures here for you. I have opened a Tastyworks and have been watching and learning from Tastytrade. I highly recommend if you have an interest in trading options that you take a look at Tastytrade, you can binge watch for hours learning about options. So, to start this off I have deposited $560 (which is an extremely small account) in my account and will be placing my first trades today. I have more capital I am willing to commit if it works well. I will be placing my first trades today so you can check back I will post my trades and how my account performs.

Subscribe to:

Posts (Atom)