So, since the last time I wrote here, I got out of the NVDA trade I put on a couple days after entry. I was tested on both sides of the iron condor and got out for a small profit. I closed my JNJ put spread for a $26 loss. I will be shying away from debit spreads due to the burn by JNJ. I closed my WMT Iron Condor at a $17 profit. I closed my XLE call spread around my 50% of max profit.

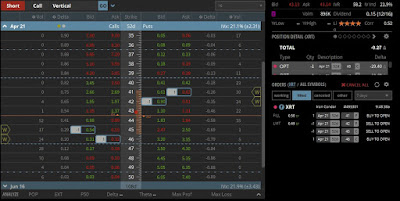

On March 6, I put an Iron Condor on in X. For this trade my call strike prices are at $42 & $43 and the puts on the original trade were $32 & 31. I this trade brought in $38 with a $62 at risk. The original trade is below. I closed this trade yesterday at $11 which is a little more than 25% of max profit

I closed my XRT trade for $10 which was 25% of my max profit and reestablished the trade adjusted down for the stock price. My current iron condor strikes on the call side are $44 & $45 and the put strikes are at $41 & $40. I brought in $32 with $68 at risk.

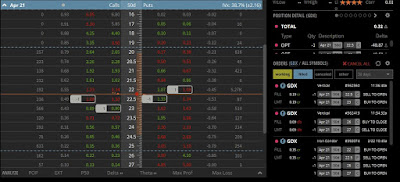

I have placed some more trades on ETFs following the Indices. I have an iron condor on IWM that brought in $40 and an iron condor on QQQ for $36. My GM iron condor is in trouble right now and my GDX iron fly is behaving but I am looking for an exit if I can get one from it.

This week I but an IC on BX which is already approaching a potential 25% profit target. I sold a put spread on NFLX for $32, and an iron condor on CSX for $32. I am trying to be more mechanical and only collect 1/3 the width of my strikes to remove some delta risk from my portfolio. I am keeping my strikes on my spreads $1 wide to stay mechanical until my account becomes larger. Now, I also start looking to manage trades at 25%. My evaluation at the 25% profit target won't be mechanical managing, if I am comfortable with the position then I will stay in it. Tastytrade was discussing the earlier managing of winners removes some P/L volatility. Collecting the 1/3 the width of the spread strikes should allow me to stay in theses trades closer to a 50% profit target with less issues of being tested. I am hoping that these small adjustments will give me some more consistent success, and allow more profitability. As always feedback is always welcomed and appreciated.