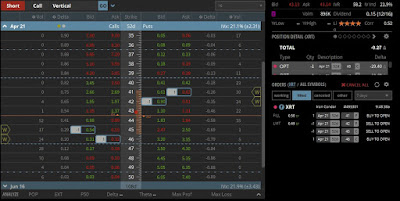

On 2/28/27, I put an Iron Condor on XRT netting $.50 with $1 wide wings. This underlying has an IV Rank of 47 at the time of this writing. My short call is at the $45 strike and the Short put is at $42. Depending on how this behaves in terms of volatility I may manage this as an Iron Fly. Below you can see the charts and where I put the trade on.

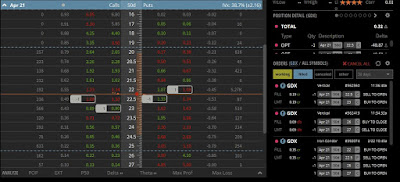

Yesterday, on 3/2/17, I moved my Iron Condor in GDX to an Iron Fly. I netted an extra $0.10 in premium and now only have $.05 at risk in this trade with 49 days left till expiration. I am not feeling very good about GDX coming back my way unless the Fed decides not hike rates. However, I feel comfortable letting this ride with $5 on the table. If I can get out of this trade for a profit I will be happy. Below you can see the updated trades on GDX and can see where I bought back the higher call spread and sold the new call spread to make this an Iron Fly.

Putting the Iron Fly on in GDX freed up some buying power for me and I put on my last trade which is an Iron Condor in NVDA for the March Expiration. I put the trades on at the 40 Delta and netted $0.71 with $1 wide wings on the condor. This seemed like a really nice risk reward matrix on NVDA. Check out the chart and trade below.

One of the things that I think has happened is that IV has expanded since I put on my other trades otherwise I would believe I should be looking to manage some of these trades soon. I have been mentored by many of you reading these either here or on r/options, I appreciate all the feedback. I promise I won't be a one trick pony with these Iron Condors forever. I appreciate all the help you have shown me and I hope I can show you that your advice has fallen on good ears with some winning trades. In closing, you can see my P/L to date, and the only loss I have locked in is that dumb move I did in TSLA with their earnings.

Any advice is always appreciated, and check back soon for more updates in trades in my Micro Options account.

No comments:

Post a Comment